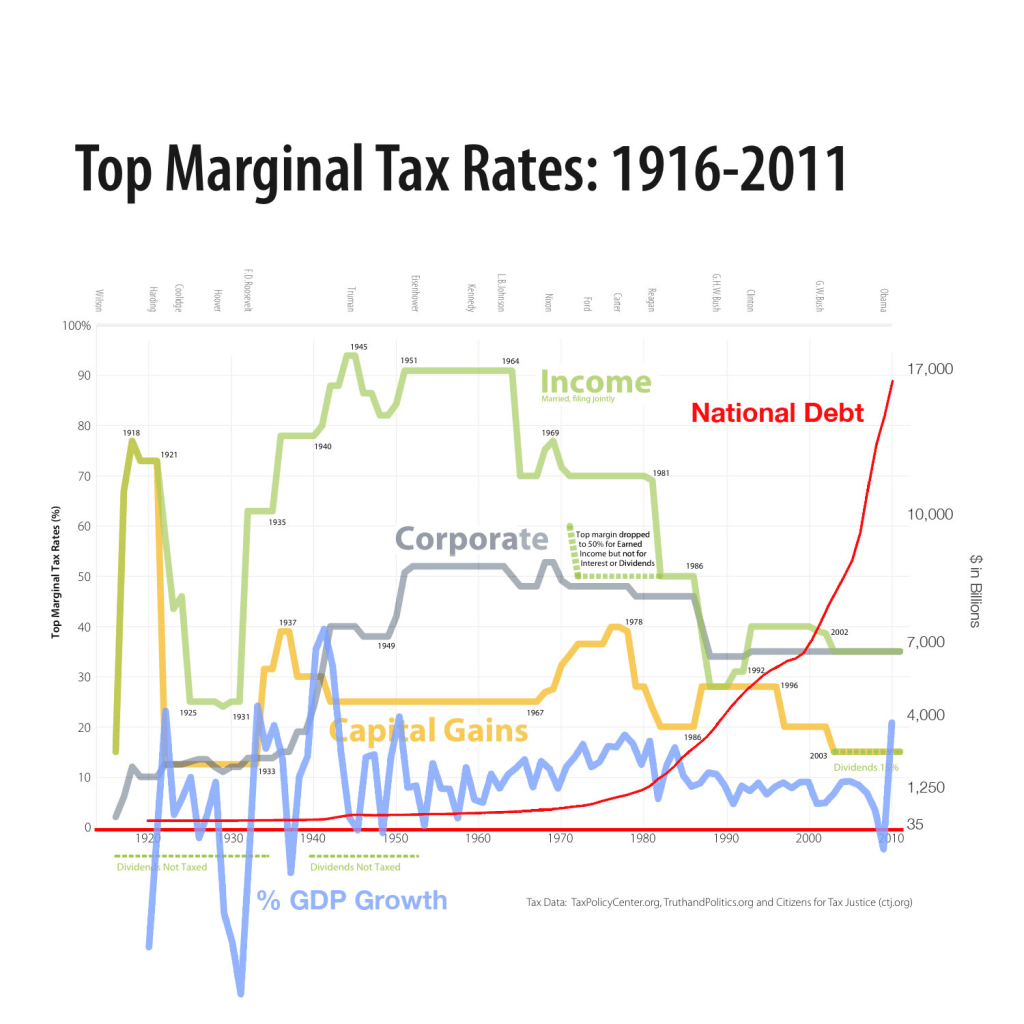

Tax Cuts For the Rich

Increases Debt for All

How Income Affects Tax Brackets:

The United States utilizes a progressive income tax system, which means that as your income increases, the percentage of tax you pay on each additional dollar earned also increases. This is achieved through tax brackets.

- Tax brackets divide income into segments, and each segment is taxed at a specific rate.

- When your income rises and you move into a higher tax bracket, the higher tax rate only applies to the portion of your income within that new bracket.

Example:

- Let’s say in 2024, a single filer’s income increases from $45,000 to $50,000.

- Based on the 2024 tax brackets, income between $47,151 and $100,525 is taxed at 22%.

- While $45,000 falls within the 12% bracket, the additional $5,000 earned (bringing the total to $50,000) pushes the individual into the 22% bracket.

- However, they don’t pay 22% on the entire $50,000. The first $11,600 is still taxed at 10%, the next portion up to $47,150 is taxed at 12%, and only the income above $47,150 (up to $50,000) is taxed at 22%.

In summary:

Middle-income individuals may experience an income tax squeeze due to inflation if their wages fail to keep pace with inflation, causing them to be pushed into higher tax brackets. While federal tax brackets are adjusted for inflation to combat this phenomenon, some states may not provide the same level of adjustments. This can result in middle-income individuals paying more in taxes even if their real income hasn’t improved.